Buy Vergütung der Vorstandsvorsitzenden im DAX 30 und Dow Jones IA Book Online at Low Prices in India Vergütung der Vorstandsvorsitzenden im DAX 30 und Dow Jones IA Reviews & Ratings

Contents

- Bazaar Agle Hafte: Watch This Video To Know Anil Singhvi’s Strategy For Monday’s Stock Market

- United Van Der share price insights

- Dow Jones News – 06 June 2014 – Page 8

- Bank of America results lift mood on Wall Street; Dow 30 up by over 500 points, S&P 500, Nasdaq Composite also gain

- More from Markets

McDonald’s Corp was the latest earnings casualty among large multinational companies after posting a lower-than-expected profit, citing a slower global economy and a stronger dollar. Valencia’s move contributed to a 1 percent drop in the S&P 500 on Friday. The benchmark index had appeared on track to exceed those losses on Monday, falling as much as 1.8 percent before recovering some of those losses.

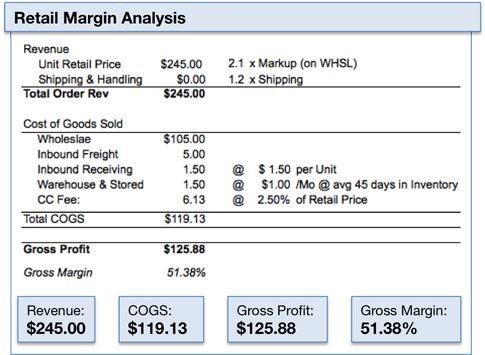

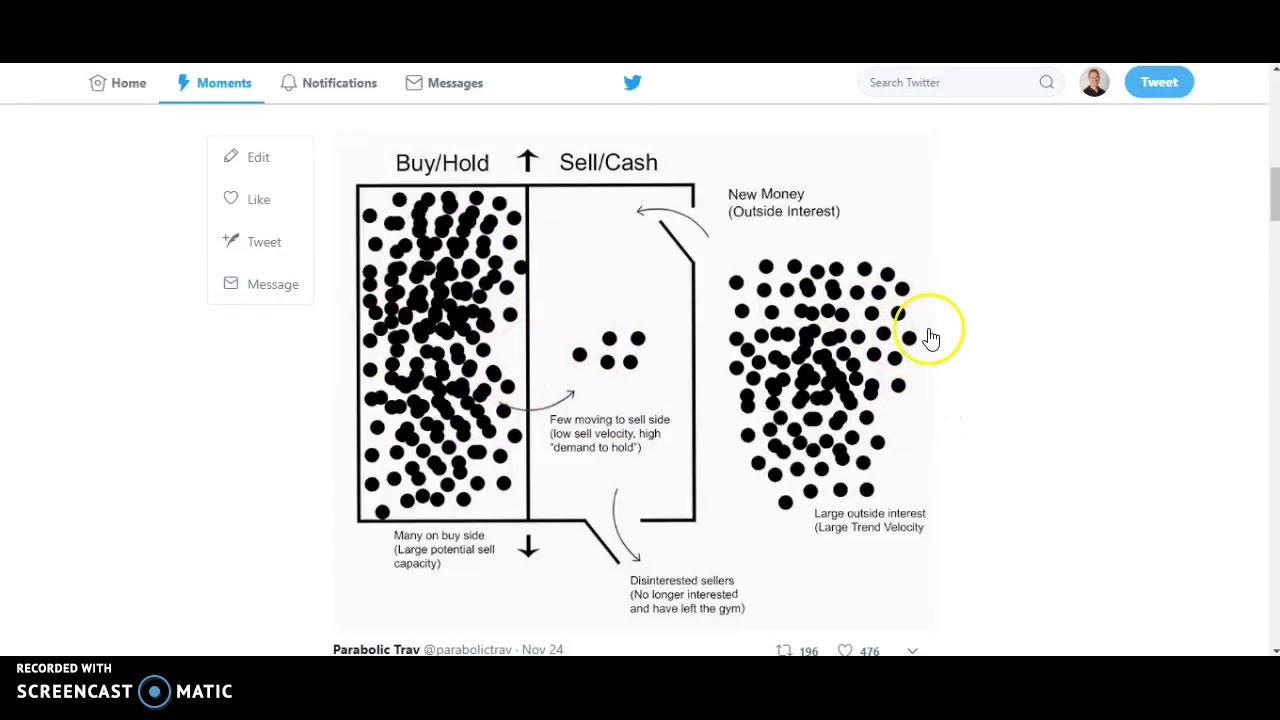

How to reduce the cases of early cancellation order before the trend finishes? We certainly don’t want to pay any additional fee to the broker for the new market entry, especially if the commission is estimated by tens of percents of earnings. In such cases, the common practice is to use additional indicators that would determine whether the signal is correct or not. These filters have a number of input parameters which need to be updated based on the subjective situation assessment, such as overbought/oversold levels of oscillators. As is widely known, the market is not aware of its own parameters and is changed unpredictably.

For the macro index formation we will be using the synthetic euro zone stock index, including the price dynamics of the portfolio composed by three popular stock indices. The basic part of the instrument contains three CFDs on DE 30 index , 6 CFDs on FR 40 index and 3 CFDs on GB 100 index . The indices are represented as continuous CFDs on corresponding futures. The chart of opening and closing weekly prices made up in NetTradeX is given below.

Since all the technical analysis signals gain statistical weight, we admit the breakout to be false. It means that after some time the market price comes back inside the price channel extending fluctuations. The CBOE Volatility Index jumped 14.4 percent to 18.62 at the close. According to the VIX Open Interest Put-to-Call ratio, VIX options traders are holding only 50 puts for every 100 calls outstanding on the VIX.

Bazaar Agle Hafte: Watch This Video To Know Anil Singhvi’s Strategy For Monday’s Stock Market

Elsewhere, WTI crude oil prices gave up a slice of the more than 8% gain from the previous day. Losses in utility companies and carmakers dragged the Stoxx Europe 600 Index into the red. Asian shares were mixed, though Tokyo’s Topix Index posted the biggest advance in two years. While there was no obvious catalyst for the return to selling that took stocks within a whisker of a bear market, the violence of yesterday’s rally made it difficult to sustain.

On May 6, 2010, the day of the flash crash, CME sent Sarao another message. All orders to CME’s electronic exchange were to be “entered in good faith for the purpose of executing bona fide transactions,” CME said, according to the FBI affidavit. When he started his allegedly manipulative trading in 2009, Sarao used off-theshelf software that he later asked to be modified so he could rapidly place and cancel orders automatically. At one point, he asked the software developer for the code, explaining that he wanted to play around with creating new versions, according to regulators.

The last time this ratio hit this level was early August of 2011, just before a huge volatility spike that lasted nearly four months, he said. The high-profile earnings disappointments have taken a toll on third-quarter estimates. Third-quarter S&P 500 earnings growth is now expected to come in at 0.9 percent, down from 3.1 percent at the beginning of the month. With 23 percent of S&P 500 companies having reported results, 67.5 percent have posted earnings above expectations, although many analysts have cut their forecasts in recent weeks, allowing for easier beats. Over the past four quarters, 68 percent of companies beat estimates.

The imbalance on the exchange due to Sarao’s orders “contributed to market conditions” that saw the derivatives contract plunge and later also the stock market, according to the CFTC. That same day, Sarao and his firm, Nav Sarao Futures Limited, used “layering” and “spoofing” algorithms to trade thousands of futures S&P 500 E-mini contracts. The orders amounted to about $200 million worth of bets that the market would fall, a trade that represented between 20 per cent and 29 per cent of all sell orders at the time. The orders were then replaced or modified 19,000 times before being cancelled in the afternoon. According to US authorities, Sarao spent the past six years thumbing his nose at regulators while using software designed to manipulate markets. In addition to fraud and manipulation, he was charged with spoofing — an illegal practice that involves placing orders with the intent to cancel before they’re executed.

United Van Der share price insights

Wire fraud is punishable in the US by maximum prison term of 20 years, commodities fraud by a sentence of as long as 25 years and commodities manipulation and spoofing by terms of as long as 10 years or a $1-million fine. The crash spooked investors, became front page news around the world and left regulators wondering how it happened. About three weeks later, Sarao told his broker that he had just called the CME and told them to “kiss my ass,” the affidavit said. Among the nearly two dozen charges, one is tied to trades from March 2014.

The instrument chart is available online, or it can be downloaded on the website and implemented in the trading terminal. We can observe that the euro zone stock index is in agreement with the German DAX over the time period under consideration, except for the false breakout of the 6th of October. The fourth tenet of Dow Theory is used as the trend signal filter.

Our payment security system encrypts your information during transmission. We don’t share your credit card details with third-party sellers, and we don’t sell your information to others.

U.S. stocks fell for a second straight session on Monday, as Spain appeared closer to needing a national bailout and poor corporate results weighed on the market. Get a free, personalized salary estimate based on today’s job market. The S&P 500 sank more than 2.4%, unable to add to a 5% surge that was the biggest since March 2009. Technology and consumer shares that led the gain were among the biggest decliners Thursday. The Dow Jones Industrial Average lost more than 500 points, after its first 1,000 point gain. The Nasdaq 100 slid more than 3%, eroding more than half of its 6% surge.

Dow Jones News – 06 June 2014 – Page 8

United Van Der share has a market capitalization of Rs 41.93 Cr. United Van Der Horst Ltd., incorporated in the year 1987, is a Small Cap company (having a market cap of Rs 41.93 Crore) operating in Engineering sector. Havens came back in vogue, with Treasury 10-year yields slipping below 2.8%, and gold climbing with the yen. When autocomplete results are available use up and down arrows to review and enter to select. Elon Musk sent a message to Twitter staff telling them that they had until Thursday to consider whether they wanted to stay on for “working long hours at high intensity” or take a severance package of three months’ pay. US prosecutors will seek to extradite Sarao, who is scheduled to appear in a UK court on Wednesday, according to Peter Carr, a Justice Department spokesman.

- Asian shares were mixed, though Tokyo’s Topix Index posted the biggest advance in two years.

- In addition to fraud and manipulation, he was charged with spoofing — an illegal practice that involves placing orders with the intent to cancel before they’re executed.

- Elsewhere, WTI crude oil prices gave up a slice of the more than 8% gain from the previous day.

The other method implies the ability to attract basic market principles. In the late 1980s Charles Dow developed six tenets of technical analysis. The fourth tenet states that market indices must confirm each other. It means that the Dow Jones Transportation Average cannot be taken into account without the Dow Jones Industrial Average .

In May 2010, Sarao’s actions created imbalances in the derivatives market that then spilled over to stock markets, exacerbating the flash crash, according to the CFTC. By all accounts, the flash crash was more than a mere technical glitch. It raised fundamental questions about how vulnerable today’s complex financial markets are to the high-speed, computer-driven trading that has come Brent WTI Spread to dominate the marketplace. That picture, according to US authorities, belies a years-long history of lightning-quick computer trading that netted Sarao $40 million in illicit profits. Sarao couldn’t be reached for comment on Tuesday and US authorities said they didn’t know whether he had retained a lawyer. Sarao didn’t cause the flash crash single-handedly, authorities say.

Bank of America results lift mood on Wall Street; Dow 30 up by over 500 points, S&P 500, Nasdaq Composite also gain

And making informed decisions when choosing to buy something. Increasing the average number of times clothes are worn is the most direct lever to capture value and design out waste and pollution in the textiles system. Today in the UK, the average lifetime for an item of clothing is only 2.2 years. Which is why all our knits come with a for-life guarantee meaning that if mending is ever required, we’ll take care of it, for life. We truly want it to be part of our customers’ wardrobe for generations.

Nonetheless, Tuesday’s developments fly in the face of the prevailing narratives of what happened. Regulators initially concluded that a mutual fund company— said to be Waddell & Reed Financial https://1investing.in/ of Overland Park, Kansas — played a leading role. Many in the industry countered that a confluence of several forces, including high-frequency trading, was probably behind the crash.

Still, stocks ended well off the day’s lows, rebounding from their initial plunge. Stocks appeared to stabilize as the S&P 500 approached its 50-day moving average of 1,332.98, a technical support level that could trigger more losses if convincingly broken. The additional great thing has been seeing the transition to a more caring and aware customer. We receive an increasing amount of questions each day on animal welfare, manufacturing, workers rights etc. It shows that they are starting to ask brands for the whole story behind the products they sell.