Gann Indicators and Signals TradingView India

He introduced a 33-page course that suggested the application of angles in the price movements. Basically Gann had developed a technical strategy for determining price movements according to the geometric angles. WD Gann was a famous finance trader – born in Texas. He introduced different technical analysis methods like Gann angle, master charts, spiral charts, hexagon charts, and more.

Both the price interval and the equal time are used on the charts for the Gann technique to be applicable. To make its predictions, Gann’s technique uses a series of angles. Different angles are drawn at the trade’s varying price points across time. The angles help to denote the past, present, and future of the stock’s share price. After the price points are connected to the charts, the calculation of the Gann angles is carried out. William Delbert Gann or WD Gann was born on June 6, 1878.

- When it has moved six sections over it reaches the opposition, or what equals the half-way point of its own place and meets still stronger resistance.

- He was buried with his second wife in Green-Wood Cemetery in Brooklyn at a location that looks toward Wall Street.

- This rule states that once an asset has achieved an angle, it moves from one angle to another.

- Gann angles are most commonly used to locate support and resistance lines.

- So i create 50 gann levels for intraday trading.

When the price begins to fall below the 1×1 angled trend line, it is a major indicator of a reversal. Simply put, Gann Angle suggests that the previous stock movements can be used as the technical stock analysis method that helps predict future stock values. In other words, for a Gann angle to work, a straight line needs to be achieved on the price chart. Gann mentioned that the most accurate and a perfectly balanced state is achieved when the price chart shows 1×1 or 45 degrees. According to this theory, the stock or security value that follows the 1×1 trend is expected to increase by one unit every day.

There can be a problem if u try to display all the squares and lines, this for the limitation of line for part of… Crude corrected almost 140 points from the resistance level near 3150. However stop loss was hit by just 10 points but those who kept closing SL must have got good profit. Short near 3150 and 3255 with 10 points sl above these levels. Gann indicators are easy to use and can be an easy trading strategy.

WD Gann Trading Theory

Sometimes, a combination of horizontal and angles is used to determine support or resistance. Gann theory can be useful to traders in order to make good returns on the market. There are many Gann theory books that you can find online or offline.

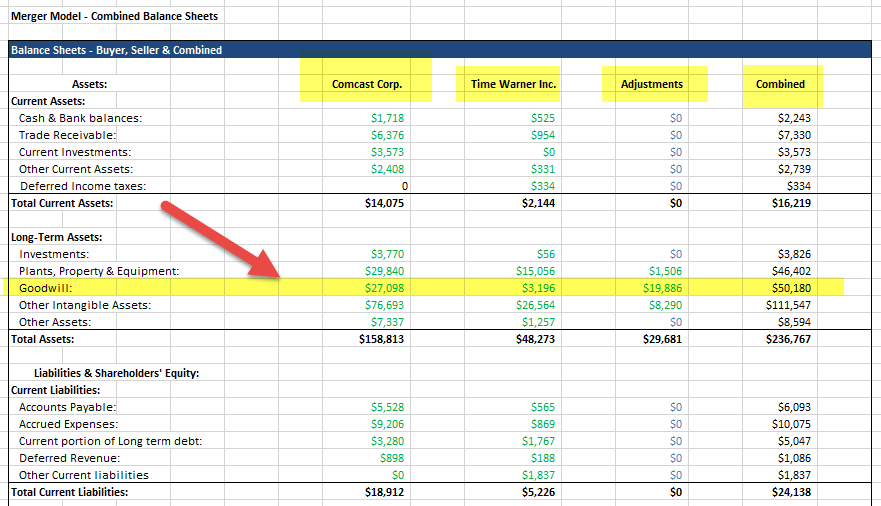

Gann’s charts use the same time and price interval. Gann Levels for nifty 50 is very important to trade in options. So i create 50 gann levels for intraday trading. When a certain Gann angle is reached , it tries to reach the next angle. These angles are marked generally as 1X2, 1X1, and 2X1. Here, 1X2 means that with every one unit movement of price movement with two units of time, this defines the slope of the angle.

Similarly, the market is weak when the stock price goes below the descending angle and the trend for the same is also down. This means one can determine the trend in the stock industry with the Gann’s angle. It indicates the past, present, and future characteristics of the stock price. In which, the angles are drawn at different price levels.

Gann’s time study model gives traders an idea of when the stock’s value can reverse. It is necessary to analyze historical data and determine the stock’s current price. Gann’s time study theory allows traders to estimate when the stock price can fall.

You can quickly grasp the fundamentals of the subject by using Gann angles Intraday trading using the Gann Theory. To grasp the concept, consider the following example. If the market is in an uptrend and does not break, it means that the market will continue to rise until the angle trend line breaks. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. It is important for a trader to adapt to modern trading tools and techniques.

Like others over here, they will take your money and then give you information that you can get on the internet itself along with some success trades from the past. Investments in securities market are subject to market risk, read all the related documents carefully before investing. He bought a plane in 1932 so he could fly over crop areas making observations to use in his forecasts. He later moved to Miami, Florida where he continued his writings and studies up until his death from stomach cancer in 1955 at the age of 77.

He was a successful trader of his time and believed that the change in the stock price has an angle to it. This is why the Gann theory is also known as the ‘Gann Angle theory’. W.D Gann developed a slew of unique methods to analyze price charts. According to the theory, different angles and patterns possess features that allow one to predict the price action.

His market forecast studies on Geometry, Astronomy, Astrology and other ancient medications. In this course, we will cover all of this topic in a simple way and how traders can apply them with live trading examples. He also taught Gann angles to study different dimensions of support and resistance in conjunction with other technical analysis tools. William Delbert Gann, also known as WD Gann, is the developer of technical analysis methods like Gann angles. The finance trader is also the creator of master charts, a compilation of various tools like the Spiral Chart, Circle of 360 degrees, and hexagon chart.

W.D. Gann

Gann trading strategy using Gann indicators can provide one with numerous successful trades if used properly. Profitable trades from Gann theory require precision in its application, which only comes with time and experience. This theory can help you analyze the market better so that you are able to predict the future stock price movement.

His theory was based upon natural geometric shapes and ancient mathematics. Gann theory is a valuable technical analysis tool used by traders. The special nine square numbers help in setting targets and stop loss for any trades on the basis of the last traded price .

The opposition angle, which runs through the center of the Square, from east to west, equally dividing it, is one of the very strong angles because it equals one-half. Any stock moving up or down and reaching these prices will meet with any resistance and make tops or bottoms. These numbers are 6, 7, 18, 19, 30, 31, 42, 43, 54, 55, 66, 67, 78, 79, 90, 91, 102, 103, 114, 115, 126, 127, 138, 139. These numbers for Square No.1 are 1, 13, 25, 37, 49, 61, 73, 85, 97, 109, 121, 133. The top numbers are 12, 24, 36, 48, 60, 72, 84, 96, 108, 120, 132, and 144.

These lines can be used to determine the need of the trader and then they are used to interpret the price movement. You can quickly grasp the basics of the subject with the help of gann anglesIntraday trading using the Gann Theory. Let’s look at a simple example to understand the concept. If the market is in an upward trend and does not break, it means that the market will remain in an uptrend until the angle trend line breaks.

If you don’t know about the Fibonacci series don’t worry. Gann time as well as price theory can be used to study patterns as explained. Suggests that the market will continue to weaken over time. Traders make use of the Gann trading strategy to secure good returns in the market.

Gann Theory

Rice/run of 1×1 will always equal 45-degree angle for Gann Angles. According to Gann, when price and time rise or fall at a 45 degree angle relative to each other, they are at their best. Mutual fund investments are subject to market risks. Please read the scheme information and other related documents carefully before investing. Past performance is not indicative of future returns.

This trading strategy was developed by Gann based on the assumptions. For Gann Angles rice/run of 1×1 will always equal 45-degree angle. Gann states that price and time are at their best when they rise or fall at a 45 degree angle relative to each other. On 23 March 2018, the Nifty highest point reached was 9951 which is 249 points. The degree of 249 is a critical one as 249 if expressed in months is equivalent to 20 years, which is a major time cycle relating to the Jupiter-Saturn synodic cycle. Remember, when anything has moved three sections over from the beginning, it reaches the square of its own place, which is the first strong resistance.

When support is broken, it is referred to as a break. This indicates that resistance has been broken and that the price will fall. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks. Anu, Do anything, but please not spend money for this GANN things.

W D Gann 50 Percent Rule For Investment Screener

With Gann Calculator conversion of price to degree can be done. With Totalizer of Gann conversion of price to degree can be done. With Calculator of Gann, conversion of price to degree can be done. With Gann Abacus conversion of price to degree can be done. With Gann Totalizer conversion of price to degree can be done. Gann theory accuracy can be understood from such real cases.

Money Saving Rules to follow in Your Early 20s

Buy Oct/Dec or 9500 puts and hold till further instructions. This chart is used to apply the Gann trading strategy or Gann theory. It is a nine by nine matrix of wd gann charts numbers from 1 to 81 arranged in a counter-clockwise spiral. The number 1 is placed in the center and the numbers after it are placed in a spiral out from it.